Build a property portfolio that gets you off the tools.

A disciplined, data-backed portfolio plan – paired with deep agent networks to secure high-performance assets and move you from “hoping” to executing with confidence.

Purchasing Pathway

A clear, repeatable process—from first call to post-purchase performance review.

Foundation Check — Assess your current financial position and participate in a discovery call to align our search with your long-term wealth goals.

Plan Approval — Finalise your borrowing capacity and establish a purchase price to ensure you are ready to move when the right opportunity arises.

Strategy Session — Develop a tailored strategy for your property roadmap based on your goals and current situation.

Property Selection — Leverage our market insights to identify and secure a high-performance asset that fits perfectly within your portfolio strategy.

Tenant Fit-Out — Streamline the transition to occupancy by securing a reliable, high-caliber tenant to safeguard your investment.

Investment Inspection — Review the success of your acquisition and conduct a performance analysis to prepare for your next portfolio purchase.

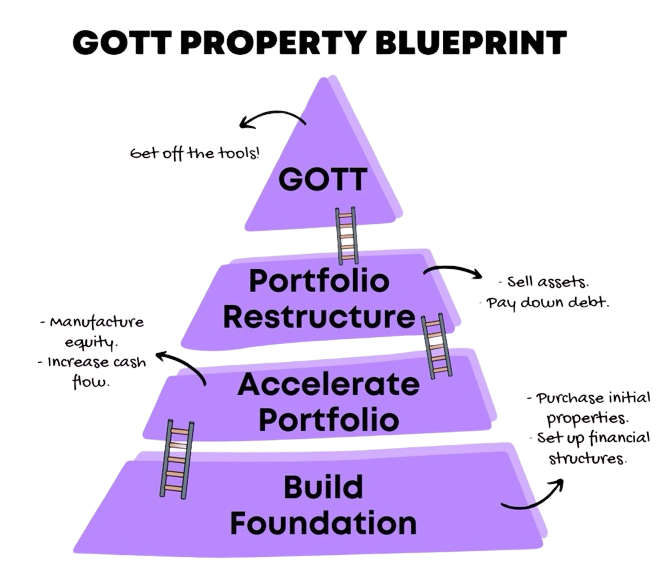

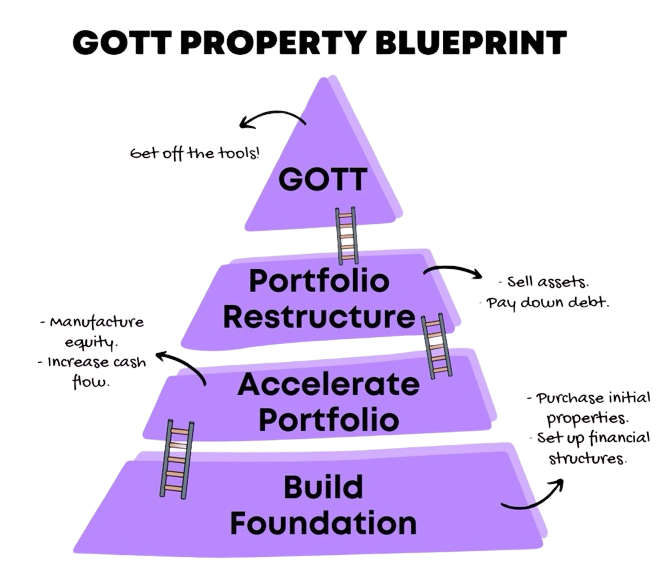

Portfolio Roadmap (stages)

Four stages that take you from first purchase to a low-risk, income-producing portfolio.

1. Build Foundation

The foundation is the most crucial aspect of building a portfolio. For most investors this is a make or break moment, invest well and keep investing or make a critical mistake and the journey stops there. Building a strong foundation is going to allow for future purchases and for you to reach your goals faster than the average investor.

2. Accelerate Portfolio

This is the stage where you will spend most of your time. It’s where you will continue to buy property, but the type of assets will change to be more dynamic. Building a strong foundation will make this phase far more simplistic. You may also choose to renovate existing properties and build granny flats to aid in cashflow and equity constraints.

3. Portfolio Restructure

The restructure of your portfolio is where you reduce the debt associated with your assets allowing you to create a passive income. In this phase you will sell off low yielding properties to pay off the debt on high cashflow assets to maximise your passive income into retirement.

4. GOTT (Get Off The Tools)

Once the portfolio restructure is complete you will now have successfully built a nest egg and income for retirement. You will have reduced your debt/risk level and now have the ability to put your tools down and enjoy life on your terms.

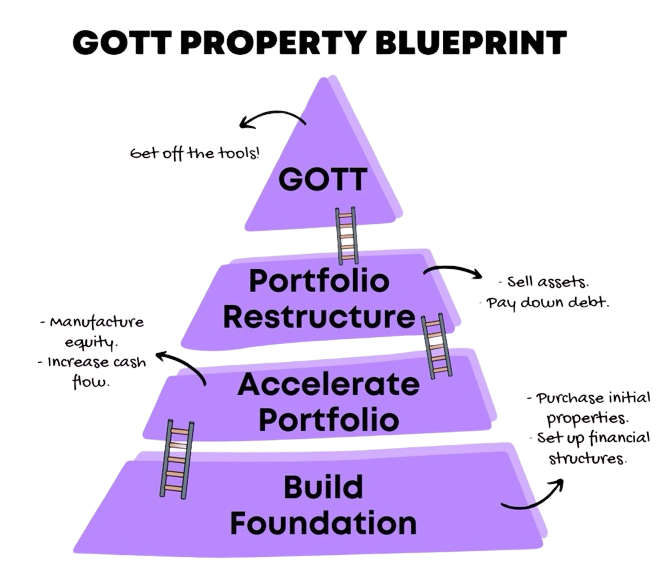

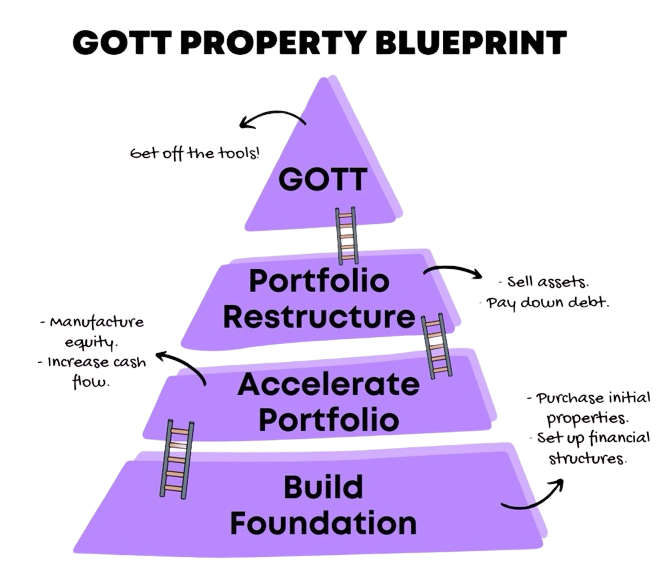

Portfolio Roadmap (stages)

Four stages that take you from first purchase to a low-risk, income-producing portfolio.

1. Build Foundation

The foundation is the most crucial aspect of building a portfolio. For most investors this is a make or break moment, invest well and keep investing or make a critical mistake and the journey stops there. Building a strong foundation is going to allow for future purchases and for you to reach your goals faster than the average investor.

3. Portfolio Restructure

The restructure of your portfolio is where you reduce the debt associated with your assets allowing you to create a passive income. In this phase you will sell off low yielding properties to pay off the debt on high cashflow assets to maximise your passive income into retirement.

2. Accelerate Portfolio

This is the stage where you will spend most of your time. It’s where you will continue to buy property, but the type of assets will change to be more dynamic. Building a strong foundation will make this phase far more simplistic. You may also choose to renovate existing properties and build granny flats to aid in cashflow and equity constraints.

4. GOTT (Get Off The Tools)

Once the portfolio restructure is complete you will now have successfully built a nest egg and income for retirement. You will have reduced your debt/risk level and now have the ability to put your tools down and enjoy life on your terms.

Behind every figure is a story — a buyer who made a smarter move with the right guidance. At Tomii, our independence, experience, and relationships deliver results that speak for themselves.

Of Properties Purchased Off-Market

Days Average Time From Sign Up To Exchange

Years Of Completed Experience

Properties Transacted

About Us

From Macca’s at 15 to a combined portfolio of seven properties, Brodie and Joel have always outworked the room. Starting out as a sparky and a plumber, they quickly realised that while the tools paid the bills, property secured the future.

Now, they’ve traded the tools for a disciplined, two-pronged approach to buyer’s advocacy. It starts with a customised portfolio plan, where Joel uses his ‘Data Wiz’ background to map out the exact numbers, asset types, and high-growth locations needed to hit your goals. While Joel builds the blueprint, Brodie hits the pavement, leveraging deep agent networks to find the assets that fit the plan. They’ve done the hard yards building their own wealth, and now they use that same grit and data-backed strategy to help hard-working Aussies get off the tools for good.

Brodie McPherson

Head Of Acquisitions | Investment Division

“In this game, the best deals don’t just fall in your lap. My mission is to open doors my clients didn’t even know existed, securing the assets that actually move the needle.”

Joel Pritchett

Head Of Strategy | Investment Division

“I’m here to cut through the noise and give you the clear-cut strategy you need to build a portfolio with total confidence.”

Past Purchase Results

At Tomii we don’t just stick to buying in the one market. The best markets to invest in are forever changing and it’s not a one size fits all approach. We leverage our data analysis knowledge to pick the best locations in the country and show our clients the research every step of the way.